Deliver 5G IoT Services Faster White Paper

Available Languages

Bias-Free Language

The documentation set for this product strives to use bias-free language. For the purposes of this documentation set, bias-free is defined as language that does not imply discrimination based on age, disability, gender, racial identity, ethnic identity, sexual orientation, socioeconomic status, and intersectionality. Exceptions may be present in the documentation due to language that is hardcoded in the user interfaces of the product software, language used based on RFP documentation, or language that is used by a referenced third-party product. Learn more about how Cisco is using Inclusive Language.

Enterprises and governments are connecting more and different types of Internet of Things (IoT) devices, and by 2026 there will be over 2.6 billion cellular-connected IoT devices. This provides a great opportunity for Communication Service Providers (CSPs) to diversify their revenue streams if they can profitably provide IoT services that meet enterprise customers’ high expectations. This white paper, intended for CSP technology leaders:

● Describes enterprise 5G IoT use cases with high revenue potential for CSPs

● Identifies the barriers you’ll need to overcome

● Provides recommendations for building a 5G IoT services business

● Briefly describes Cisco IoT as a Service, a state-of-the-art solution providing 5G SA core network functions with a distributed edge architecture, consumed as a service

5G IoT services — A burgeoning revenue opportunity

By 2023, the number of global machine-to-machine connections will reach 14.7 billion.[1] 5G is becoming the de facto wireless standard for IoT, and CSPs that offer a 5G IoT service stand to capture the largest share of revenues. This is especially important for CSPs looking for new enterprise revenue streams.

With past network transitions, CSPs have generated incremental Average Revenue Per Units (ARPUs) with their consumer business using a monolithic service focused on data speed and allowance as the key pricing levers. With 5G IoT services, CSPs can move beyond this model by offering value-added IoT applications and/or bundled services to deliver compelling enterprise solutions and subsequently drive monetization through strategic partnerships.

It is estimated that with 5G, more than 50% of the CSP revenue in the next decade will be driven by the enterprise IoT market segment. Several factors will influence how global CSPs leverage 5G’s faster speeds, superior performance, and software-defined, service-based architecture to accelerate 5G SA network deployment and drive monetization. The biggest of these is enterprise demand.

Enterprise use cases driving 5G adoption

Connected car applications such as fleet management, in-vehicle entertainment systems, emergency calling, mobile hotspots, vehicle diagnostics and navigation, and so on will be the fastest growing category, at a 30% CAGR. Connected city applications will have the second-fastest growth, at 26% CAGR. Enterprises at various stages of their digital transformation journeys are starting to embrace 5G for IoT initiatives.

5G use cases are typically classified into three broad categories defined by differentiated service requirements, performance characteristics, and network KPIs:

● Enhanced Mobile Broadband (eMBB)

● Ultrareliable Low-Latency Communications (uRLLC)

● Massive Machine-Type Communications (mMMTC)

Each of these differentiated services with user-defined, application-specific QoS and performance requirements can be offered as network slices with service assurance. Network slicing is a key technology enabler for 5G, which enables CSPs to offer services at premium price points. Based on these differentiated service requirements, each network slice can have one or more edge nodes to enable functional outcomes for the enterprise use cases in play. All 5G enterprise use cases will be served by any one of these slice-based services.

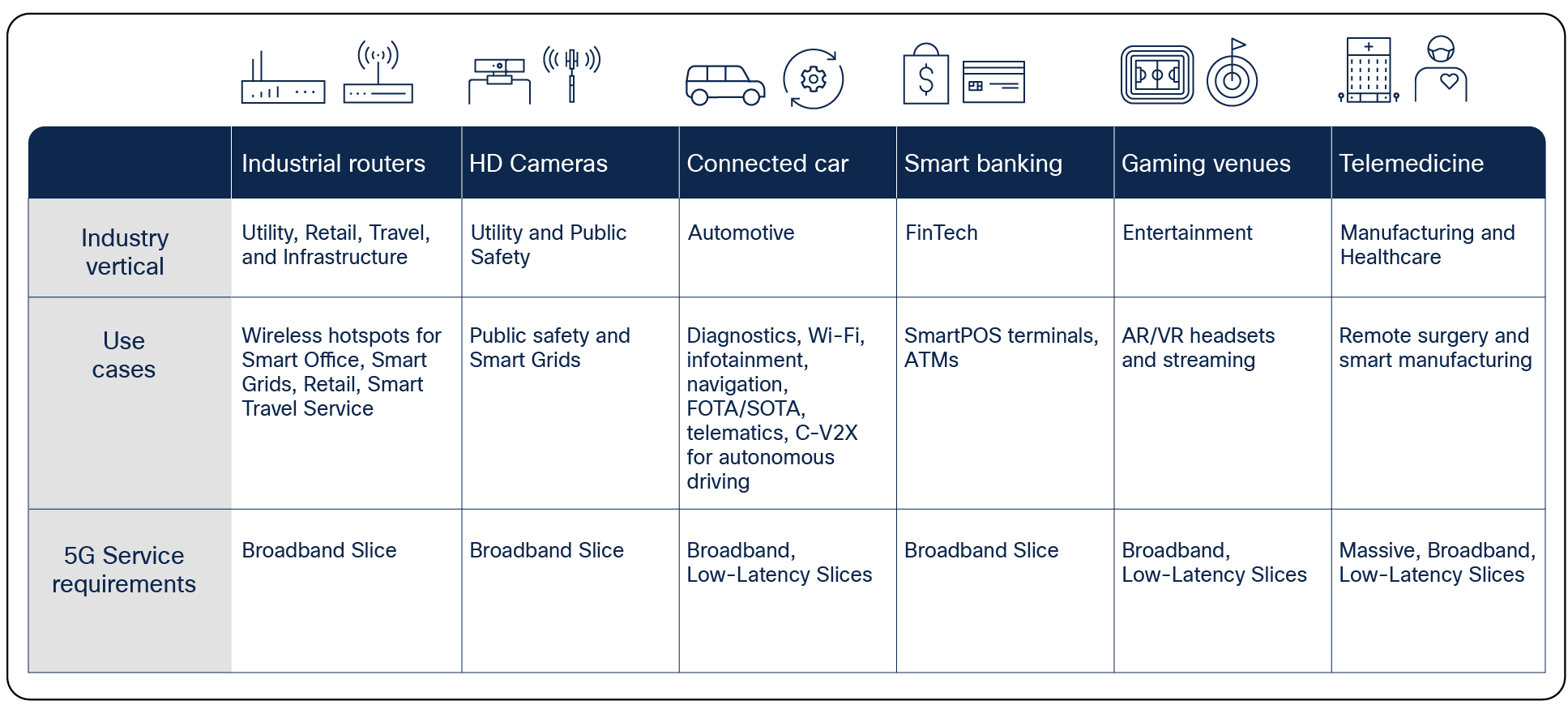

Figure 1 shows the 5G-powered enterprise use cases that are predominantly in China and in other select global geographies that have a live 5G SA network. CSPs in other geographies are also embracing these opportunities ahead of them.

Enterprise use cases across industry verticals with 5G service requirements

Connected Vehicles

With major transformative trends like electrification, autonomous driving, and mobility in the automotive and commercial vehicle industry, vehicle manufacturers (OEMS) are driving adoption of public 5G services globally to support new business models based on cellular connectivity. This trend is evident from BMW’s planned launch of 5G-enabled vehicles in July 2021 in China in partnership with China Unicom. Cisco IoT as a Service were instrumental in helping launch the world’s first 5G IoT network in October 2020. We also see this trend taking shape in North America with GM’s planned launch of 5G-enabled connected cars in the US and Canada.

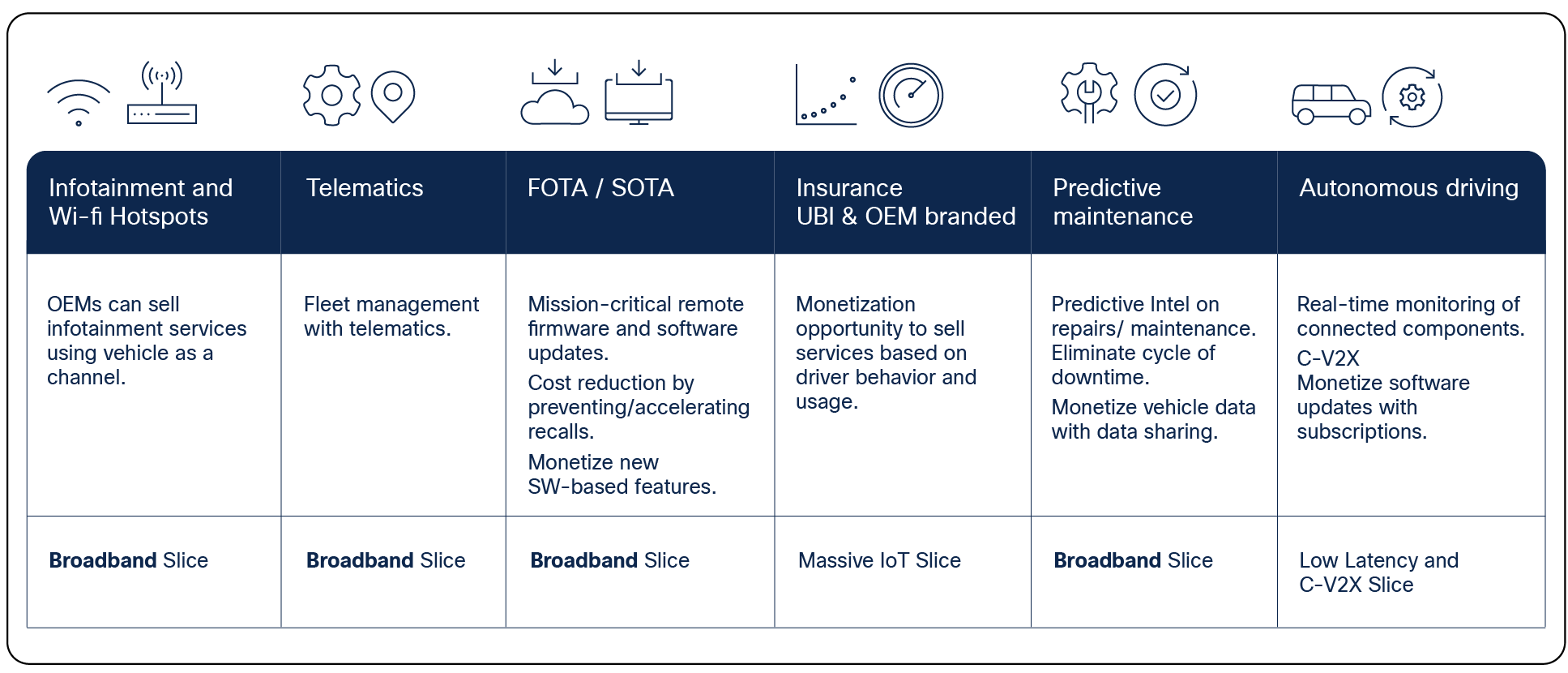

A connected car is the most sophisticated IoT device today, with onboard applications or services ranging from telematics services to enable predictive maintenance of vehicle components, infotainment services to enable audio and video streaming applications (Netflix, Spotify), onboard Wi-Fi, high-definition maps, and marketplaces for retail use cases.

Vehicle OEMs are building new business models based on these SW-enabled subscription services, and as a result the global connected car subscription business is expected to reach almost $65 billion in 2028. For example, General Motors, a major global OEM headquartered in the US, plans to generate $135 of monthly recurring revenue (MRR) per vehicle with new connected, onboard services such as Super Cruise, Maps+, OnStar Insurance, OnStar Vehicle Insights, , and Connected Camera, as highlighted during their Investor Day 2021 event.

Vehicle OEMs are also looking at 5G to be a critical enabler for autonomous driving with cellular-vehicle-to-everything (C-V2X) services – where the car communicates with neighboring vehicles, roadside units (RSUs), and an edge cloud. C-V2X requires periodic mapping updates and predictive intelligence with automated assurance to detect service anomalies and drive corrective actions. Software-defined vehicles are also enabling personalized collaboration applications for consumers to be connected to work, on the go. Ford’s recent partnership with Cisco to enable WebEx conferencing paves the path for mainstream adoption by other OEMs.

Commercial vehicle OEMs are driving adoption of Autonomous Trucking (AT) technologies and building homegrown fleet management solutions. Pervasive connectivity with edge deployments supporting mission-critical C-V2X communications is a prerequisite for these OEMs to embrace autonomous trucking. Platooning, considered to the first commercial AT application, is expected to generate TCO savings of approximately 45% by the end of this decade. Fleet management solutions for electrified, autonomous trucks will subsequently leverage 5G connectivity for predictive diagnostics and maintenance of vehicle components and powertrain.

Connected vehicle applications and services

New enterprise use cases

With the onset of 5G, we see new use cases that were rare with prior network technologies. Ruggedized wireless routers are now 5G enabled and used to enable wireless connectivity for 5G-capable HD cameras and AR/VR systems in various industries like utilities, travel, smart cities, and public safety. 5G-enabled wireless routers are also being used to wirelessly backhaul traffic in areas with limited broadband connectivity and provide Fixed Wireless Access services (FWA). FWA is touted as a leading mobile broadband technology that can serve enterprises and consumers alike, leveraging CSP’s spectrum and network densification strategy. CSPs with access to mid- or high-band mmWave spectrums with a nationwide radio footprint, including suburban and rural areas, can leverage their planned core network deployment to offer broadband services. A few North American CSPs have led a 5G FWA rally, touting it as the leading consumer 5G use case besides 5G-enabled smartphones. Europe on the other hand has good adoption of FWA services today, with enterprises across transport and logistics, retail, and educational sectors choosing to upgrade to 5G FWA services in the next 12 to 24 months. Applications across these sectors that would leverage FWA services range from enterprise operations management applications (on-premises or cloud) to e-commerce services and in some cases monitoring and predictive analytics applications.

Other enterprises are starting to embrace 5G with plans to refresh existing devices as part of technology migration and launching new upgraded devices with 5G modems. There are a few barriers to enterprise adoption, like device availability, which we will address in another section.

To realize the promise of connected transportation, connected and autonomous vehicles require the high-throughput and low-latency connectivity provided by 5G with a distributed edge architecture. Two technology trends provide the key to realizing that promise.

Cloud adoption. As CSPs continue to invest in network densification (post spectrum acquisition) and core network deployment, there is a massive impetus to transition to fully virtualized, cloud-native RAN components and network functions. Additionally, there is an industry-wide transformation to deploy telco and enterprise workloads on a public cloud, to leverage cost savings led by each of the major hyperscalers’ telco cloud strategy. CSPs are looking to minimize CapEx investments and recurring OpEx required to start up, maintain, and scale network services, by enjoying the cost benefits of a hyperscaler-led multicloud deployment and a fully distributed, global footprint. A multicloud, hybrid deployment telco cloud strategy has also led to the convergence of telco network edge, public cloud, private cloud, and most importantly enterprise applications, which can now coexist with network functions.

Software-defined networks and decentralized architecture. In combination, software-defined networks and decentralized architecture enable compute and intelligence at the network edge. This decision making closer to the edge of the network is essential for mission-critical, connected vehicle applications that enable autonomous driving or periodic mapping updates. Software-defined networks and decentralized architecture provide the foundation for the network with predictive intelligence to detect anomalies ahead of a potential downtime or service disruption. Stringent SLA requirements for autonomous driving, periodic mapping updates, or C-V2X scenarios require a great degree of distribution – of the RAN and UPF edge components – which will need to coexist with enterprise applications to enable mission-critical outcomes.

The following headwinds are delaying CSP and enterprise 5G investment and adoption in certain geographies.

Spectrum acquisition and network densification is a costly endeavor requiring a massive capital investment by CSPs. 5G rollout in global geographies is usually tied to spectrum auctions by regulatory bodies. For example, in the US, the FCC is constantly licensing frequencies for CSPs to use. CSPs in the US have collectively spent about $117 billion for the C-band spectrum and 7.57 billion dollars for the mmWave spectrum. Post spectrum acquisition, CSPs need to invest several more billion in radio gear, deployment sites, and so on to put this spectrum in play with RAN deployments to offer faster speeds and additional network capacity. AT&T, for example, has spent $24B in capital investment for 5G rollout thus far.

GSMA Intelligence estimates that 5G investments will make up 97% of North American CSPs’ capital spending between 2021 and 2025 — 63% for Latin America, the Middle East, and North Africa and 34% for sub-Saharan Africa.[2]

5G device availability. Factors holding back enterprise 5G adoption include limited 5G-enabled devices and premium device price points. Based on GSA’s 5G Device Ecosystem report from December 2022, there are fewer than 11 in vehicle routers with embedded 5G modems and 84 devices including drones, head-mounted displays, robots, TVs, cameras, femtocells/small cells, repeaters, vehicle onboard units, a snap-on dongle/adapter, a switch, a vending machine, and an encoder that are commercially available today. The larger challenge is building an integrated IoT device with embedded components at a competitive price point. The 5G device ecosystem continues to grow at a rapid pace but not to an extent that helps manufacturers achieve economies of scale. As such manufacturers have not begun mass production of 5G-enabled IoT devices yet.

5G SA core network deployment with a distributed edge footprint. CSPs need to establish a core network deployment strategy that enables the required enterprise 5G-based capabilities. This deployment infrastructure is technically complex and requires significant capital investment and technological expertise to start up and scale. It requires thorough network planning with orchestration and automation components to seamlessly interoperate with a fragmented set of network function vendors that CSPs could choose to use.

5G monetization strategy. The lack of a clear strategy to maximize return on 5G investments is another reason CSPs have held back 5G rollouts. The enterprise IoT business is relatively new to many CSPs, and they don’t have a strong history building business models based on value-added services. This can be seen in how CSPs participated in the mobility value chain to offer LTE services. Smartphone manufacturers, chipset manufacturers, and application developers capitalized on the market opportunity. CSPs, on the other hand, were focused on enabling the backend network infrastructure to make this transition possible, while leveraging their legacy pricing mechanism – focused on speed and usage – to monetize services.

Recommendations for building a sustainable 5G IoT business

CSPs looking at starting up 5G IoT services can consider optimizing their spectrum deployments to offer added capacity and performance improvement for their subscribers – consumers and enterprise users – by upgrading their current radio sites with antenna upgrades and so on. For other CSPs looking at targeted monetization outcomes in specific geographies, the focus could be limited to understanding the regional usage patterns, and the consumer and enterprise appetite to consume new premium services.

To be successful and profitable in the 5G world, it is imperative for CSPs to have a deep understanding of the 5G-enabled services and consumer experiences their enterprises are trying to enable, and subsequently establish the foundational technical capabilities that are required. For example, vehicle OEMs are looking for dedicated network slices with stringent SLA requirements and service assurance to get full visibility and control into their network services.

Additionally, OEMs are also seeking the ability to create slice-based network services on demand or optimize network capacity on existing slices by adding edge UPFs, Multiaccess Edge Computing (MEC) services, and enterprise applications to coexist with each other, at the location and hyperscaler of their choice. CSPs will need a distributed edge footprint, orchestration, automation components, and most importantly the right partnerships to facilitate this complex infrastructure buildout.

CSPs need to consider delivering the capabilities that vehicle OEMs need as a service. This opens a unique opportunity for CSPs to offer different kinds of value-added services, move up the value chain, and drive 5G monetization.

Start with a strong foundation

Winning tomorrow’s lucrative 5G IoT business depends on having a 5G SA infrastructure that provides the sophisticated capabilities that enterprises need. As many CSPs have realized, building this infrastructure is technically complex and requires significant upfront capital investment and technological expertise to start up and scale.

Building on Cisco’s industry leadership in creating the world’s first 5G SA IoT network and first consumer 5G SA network in North America, Cisco has introduced Cisco IoT as a Service to provide CSPs the advanced functionality needed to capture mid- and high-ARPU enterprise business. Delivered as a service, Cisco IoT as a Service provide the building blocks needed to launch and operate 5G IoT services.

Cisco IoT as a Service are fully hosted, managed, and delivered as a service to our CSP partners. Cisco IoT as a Service is built to help CSPs launch and monetize 5G IoT services by expediting their time to revenue and lowering costs. For CSPs in geographies that are in the early stages of spectrum acquisition and planning network deployment, Cisco IoT as a Service offers a graceful evolution to start up with LTE IoT services and scale with 5G in the future, leveraging the industry’s first truly 5G SA converged core.

Cisco IoT as a Service are built on the industry-leading Cisco IoT Control Center Connectivity Management Platform (CMP) and a 5G SA converged core mobility network functions portfolio, which is used to serve over 100 million IoT subscribers today across a broad spectrum of use cases, ranging from connected cars to industrial IoT. Cisco IoT as a Service building blocks include:

● IoT Control Center

● Cloud-native 5G SA converged core network functions

● Converged Charging Function

● Orchestration and Automation stack

● Open APIs to drive CSP and enterprise functional outcomes

CSPs looking to launch basic services to serve simple use cases with a default slice may not need complex orchestration with their RAN and transport components. CSPs looking to serve connected car use cases, offer value-added services, and drive 5G monetization will need tight-knit integration with Cisco IoT as a Service.

With continuous innovation across the Cisco IoT as a Service technology stack, we will be introducing new self-serve functionalities to offer full visibility and control for CSPs and enterprises. These functionalities include on-demand network slice service creation and lifecycle management, slice analyzer, and edge orchestration with service assurance. Additionally, as part of our innovation roadmap and continued investment, Cisco is building a state-of-the-art, next-generation decentralized architecture with a global footprint. This architectural transformation has been envisioned to cater to the needs of the connected vehicle OEMs to leverage edge computing to offer new B2C services and the broader telecom industry transformation to embrace 5G.

Learn more

You can find more information about Cisco IoT as a Service technology and architecture in the

Cisco IoT as a Service Solution Overview.