18

Cybersecurity in ASEAN: An Urgent Call to Action

•

Technological evolution will render threat monitoring and response more complex, particularly

given the rise of encryption, multi-cloud operations, proliferation of IoT, and convergence of OT

and IT environments.

These four issues will aggravate the current, unprepared situation in the region. If the region

fails to address these issues, the value-at-risk for ASEAN is significant: The region’s top listed

companies could be exposed to a $750 billion erosion in current market capitalization. In

addition, cybersecurity concerns have the potential to derail the region’s digital innovation

agenda, one of the core pillars for its success in the digital economy.

2.1 The cybersecurity challenge is likely to getmore complex

2.1.1 Systemic riskwill make the region only as strong as itsweakest cyber link

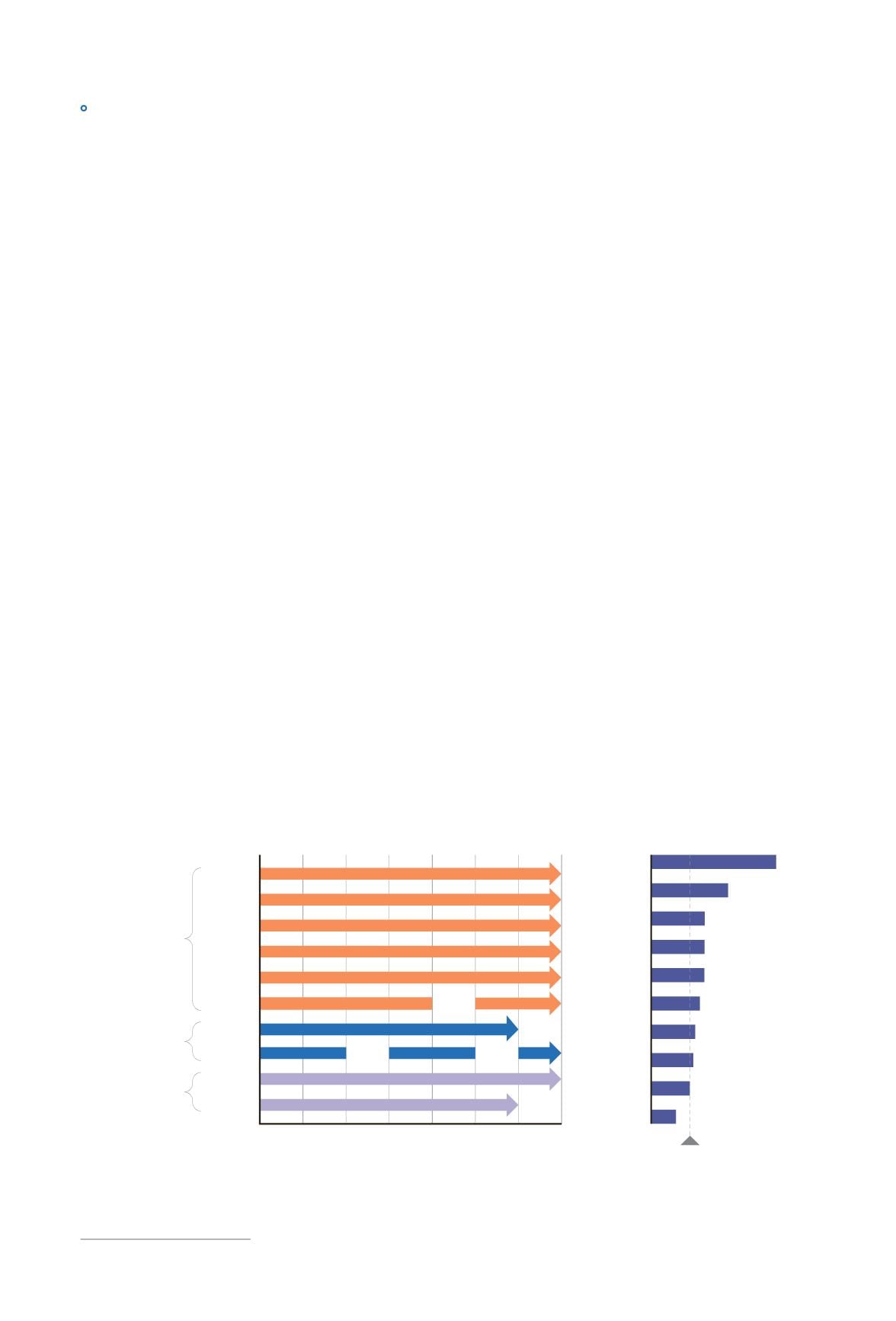

With growing intraregional trade and business linkages across ASEAN countries, the risk of

contagion in the event of cyberattacks across the region is high. Figure 14 highlights the

extensive footprint that banks, e-commerce companies, and transportation companies have

across the region. For eight out of the 10 ASEAN countries, intra-regional trade accounts from

more than 20 percent of total trade. Intra-ASEAN investment has also been steadily increasing

over the years and in 2016 accounted for a quarter of the total foreign direct investment (FDI)

flows of $96 billion into the region.

20

Sectors with the highest proportion of intra-regional

investment include manufacturing, financial services, and real estate.

Factors that have contributed to the rise in intraregional investment are the growing financial

strength and significant cash holdings of ASEAN firms and their drive to internationalize for

greater competitiveness and to access markets, natural resources, and strategic assets.

Regional footprint of ASEAN businesses

Figure

Regional footprint of ASEAN businesses and member states’ share of intraregional trade

Source: A.T. Kearney analysis

Singapore

Malaysia

Thailand

Indonesia

Rest

Philippines

Vietnam

Finance

E-commerce

Transportation

DBS

OCBC

UOB

Maybank

Standard

Chartered

CIMB

Lazada

Zalora

AirAsia

Grab

Share of intraregional trade

of total

Laos

Myanmar

Brunei

Singapore

Malaysia

Thailand

Cambodia

Indonesia

Philippines

Vietnam

. %

. %

. %

. %

. %

. %

. %

. %

. %

. %

%

National threshold

20

ASEAN Secretariat, ASEAN FDI database